Quick Take

As we come close to the Bitcoin halving and quote goodbye to the present date, it is important to assess the occasions that have actually taken place considering that the previous halving in Might 2020. The globe has actually experienced a collection of substantial occasions that have actually formed the financial landscape and affected the fostering of Bitcoin.

The COVID-19 pandemic, which started in March 2020, had a harmful result on the international economic climate throughout the whole cycle. The results of the pandemic has actually resulted in serious rising cost of living and money reduction, the results of which are still really felt today.

In August 2020, Michael Saylor, after that Chief Executive Officer of MicroStrategy, made a strong action by embracing Bitcoin, leading to the firm gathering greater than 1% of the overall Bitcoin supply since April 2024. The FASB presented regulations that will favorably affect company fostering by developing reasonable worth accountancy for Bitcoin in company treasuries.

El Salvador made background by making Bitcoin lawful tender and carrying out a dollar-cost averaging (DCA) method to obtaining the electronic possession.

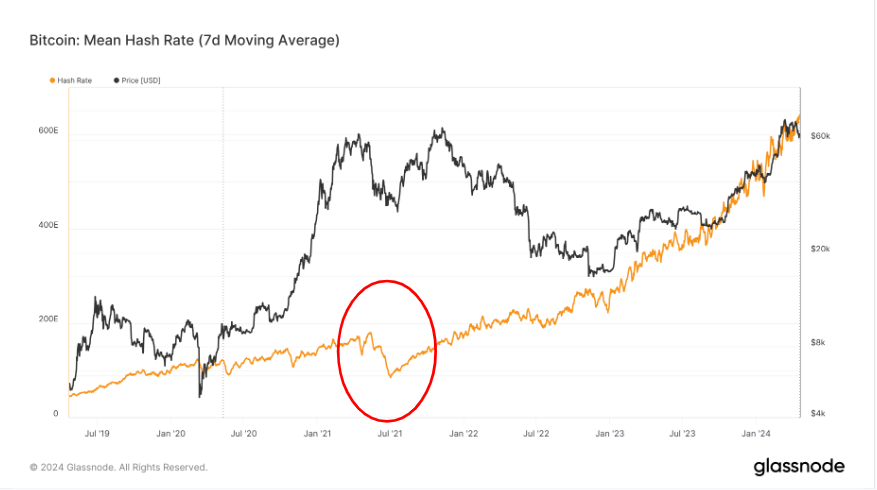

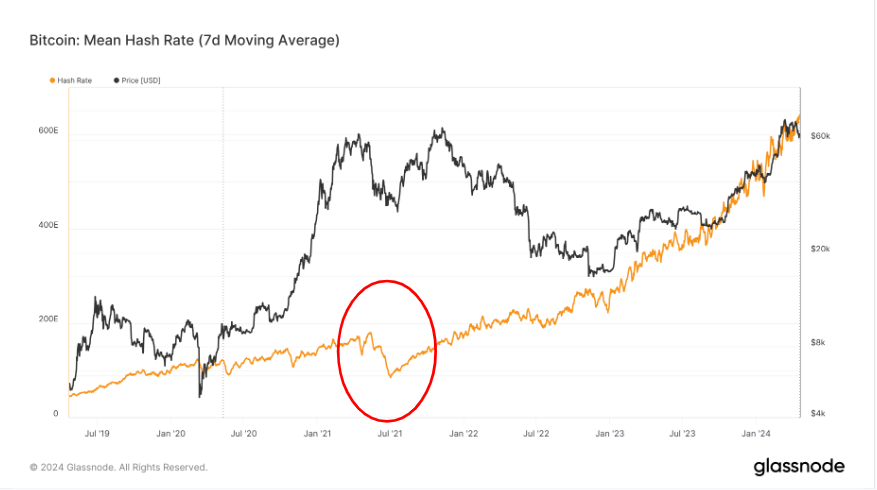

China’s restriction on Bitcoin in the summer season of 2021 triggered a considerable decrease in the hash price, which dropped by around 50%.

Hash Price: (Resource: Glassnode).

Geopolitical stress rose, with several battles and intrusions happening, most significantly Russia’s intrusion of Ukraine in February 2022 and the current problem between East.

The intro of Bitcoin ordinals led the way for the launch of Runes at block 840,000.

This cycle additionally noted the very first time that the equilibrium of Bitcoin on exchanges lowered, suggesting a change in capitalist actions.

Exchange Equilibrium: (Resource: Glassnode).

In this cycle, the electronic possession exchange FTX fell down along with numerous crypto borrowing systems like Celsius and BlockFi.

In January 2024, the launch of Bitcoin ETFs ended up being an instantaneous success, additional strengthening Bitcoin’s setting in the economic globe.

Various other significant occasions consisted of the highest possible rising cost of living and rates of interest in current background, advising us that while the future continues to be uncertain, the restricted supply of 21 million Bitcoin continues to be a continuous.

Regardless of the difficulties and occasions that have actually unravelled, Bitcoin has rose a remarkable 577% considering that the last halving.

Percent of 21M Supply Extracted: (Resource: Glassnode).

The blog post Bitcoin’s durability evaluated: Cost up 577% amidst pandemics, battle and company accept showed up initially on CryptoSlate.