It’s been a whipsaw 2023 for financier belief, and although equities markets have actually resisted assumptions, a current record from ARK Invest highlights reasons the rest of 2023 might offer a number of financial difficulties.

ARK handles $13.9 billion in properties, and its Chief Executive Officer, Cathie Timber, is a solid supporter for cryptocurrencies. In collaboration with the European property supervisor 21Shares, ARK Financial investment initially got a Bitcoin (BTC) exchange-traded fund (ETF) in June 2021. Its newest ask for a place BTC ETF, which is presently pending testimonial by the USA Stocks and Exchange Payment, was originally submitted in Might 2023.

Lasting favorable, temporary bearish?

Regardless of ARK’s favorable sight on Bitcoin, which is sustained by its study on just how the blend of Bitcoin and expert system might change company procedures by favorably influencing efficiency and prices, the investment company does not visualize a simple course for a Bitcoin bull run offered the present macroeconomic problems.

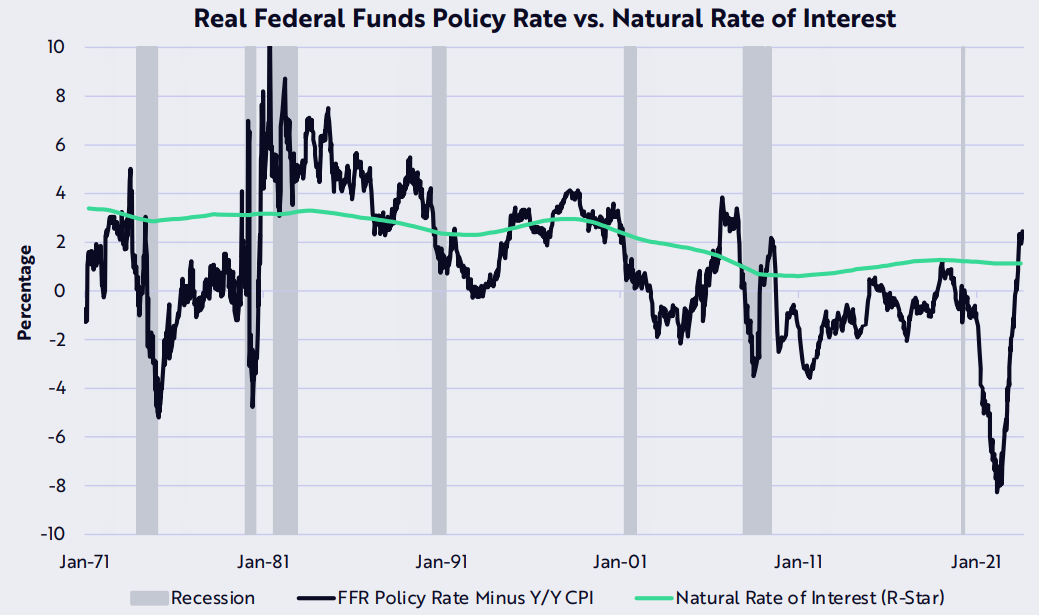

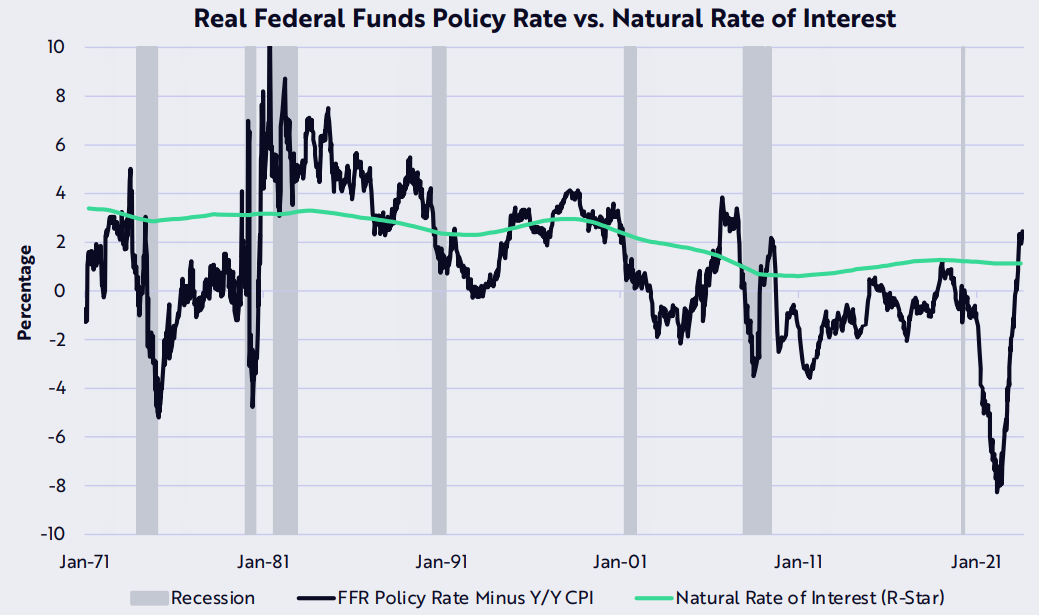

In the e-newsletter, ARK mentions a number of factors for its less-than-optimistic situation for cryptocurrencies, consisting of rates of interest, gdp (GDP) approximates, joblessness and rising cost of living. One factor is that the Federal Get is carrying out a limiting financial plan for the very first time considering that 2009, as suggested by the all-natural interest rate.

Federal Get all-natural interest rate. Resource: ARK Financial Investment

The “all-natural interest rate” is an academic price at which the economic situation neither increases neither agreements. ARK describes that whenever this sign surpasses the actual government funds plan price, it taxes borrowing and interest rate.

ARK expects that rising cost of living will certainly remain to decrease, which would certainly increase the actual government funds plan price and raise the space over the all-natural interest rate. Basically, the record holds a bearish macroeconomic sight as a result of this sign.

The experts additionally concentrated on the aberration in between actual GDP (manufacturing) and GDI (revenue). According to the record, GDP and GDI must very closely straighten, as revenue made must amount to the worth of items and solutions generated.

Nevertheless, one of the most current information reveals that actual GDP is around 3% greater than actual GDI, showing that descending alterations in manufacturing information must be anticipated.

An additional prime focus was united state work information, and the experts keep in mind that the federal government has actually modified these numbers downward for 6 successive months.

united state nonfarm pay-roll alterations. Resource: ARK Financial Investment

The graph over highlights a labor market that shows up weak than first records suggested. The truth that the last time 6 successive months of descending alterations took place remained in 2007, right before the start of the Great Financial Situation, is additionally significant.

Connected: Bitcoin temporary owners capitulate as information highlights possible generational acquiring possibility

” Stagflation” is typically bearish for risk-on properties

An additional bearish growth to watch on is “stagflation.” The authors highlight the turnaround of the perennial pattern of cost discount rates driven by boosted customer costs. Referencing the Johnson Redbook Index, which incorporates over 80% of the “main” retail sales information assembled by the united state Division of Business, it ends up being clear that overall same-store sales recoiled in August for the very first time in one year, recommending that rising cost of living might be putting in higher stress.

Johnson Redbook retail sales index. Resource: ARK Financial Investment

The metrics recommend that continuous macroeconomic unpredictability might proceed in the coming months. Nevertheless, it does not give a clear response concerning just how cryptocurrency capitalists could respond if this pattern verifies reduced financial development and greater rising cost of living– a situation commonly taken into consideration very negative for risk-on properties.

This post is for basic details functions and is not planned to be and must not be taken as lawful or financial investment recommendations. The sights, ideas, and point of views shared right here are the writer’s alone and do not always mirror or stand for the sights and point of views of Cointelegraph.